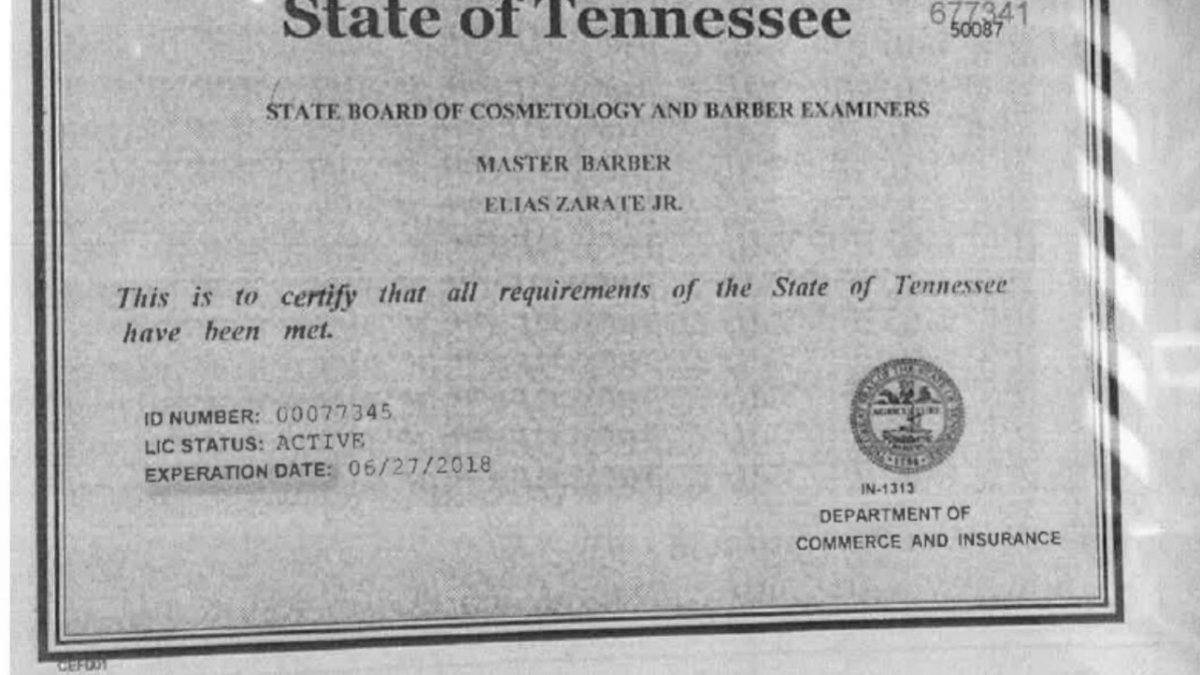

Most businesses within Knox County must obtain a business license. For questions regarding Knox County Business Tax Licenses, please call 86.For questions regarding tax law, filing or paying business taxes, call 1-80.After reading the information outlined below, direct your questions accordingly: The following information is intended to inform you of Business Taxes in general, and is not designed to completely address all laws and regulations. Reclassification as a Standard BusinessĬlick Here to Apply for A Business License Click Here to Search New Business Listings Click Here to File a Business Tax Return/Renew Business License Click Here to Obtain a Blank Business Tax Return.Every application is judged on a case-by-case basis.Ĭlick on the links for more information regarding COSMETOLOGY RECIPROCITY REQUIREMENTS AND INSTRUCTIONS and BARBER RECIPROCITY REQUIREMENTS AND INSTRUCTIONS. NOTE: Reciprocity with the TN state board is not a uniform process. Transcript of Education Hours (Not required for GA applicants)

sworn affidavit, tax returns, letter from employer, etc.).ģ.

practicing as a licensee for at least 1 of the last 3 years, orī. practicing as a licensee for at least 3 of the last 5 years.

If you originally received less hours in school than our state requires, you will need to submit to us documentation showing Ī. CORE Application, "Initial Out of State _"Ģ. Request a License Certification History from every state where you have held a license.Ģ. Reciprocal Cosmetology and Barber applicants will need to follow the steps below to obtain a Tennessee license:ġ. States in which the licensee has substantially met the qualifications for licensing in Tennessee may be eligible to receive a reciprocal license in Tennessee.

0 kommentar(er)

0 kommentar(er)